Imagine this: You start accepting Bitcoin as a method of payment for your small business – you think it will be a great way to open yourself to a larger market. At first, you notice a large uptick in the number of clients you’re working with, and many of your current clients begin to pay via Bitcoin.

All is going well until a few months after you first started accepting Bitcoin. You notice that many of your clients are heading to your leading competitor, who has been able to poach your customers and source the exact same products as you. You’ve always done a great job of keeping your data secure, so you’re unsure how your competitor could rapidly replicate your business, find your suppliers, and steal your customers. This might sound like a nightmare, but it’s the harsh reality many business owners go through.

In this article, we take a look at components of Bitcoin transactions that might leave your business and customers exposed to privacy risks. You don’t want to join the thousands of small business owners and freelancers that have suffered the financial consequences of transaction data theft.

Address Reuse

Many people believe that Bitcoin is one of the most private ways to send and receive money. Unfortunately, this is not true if you use traditional Bitcoin wallets.

One of the primary problems with traditional Bitcoin wallets is address reuse. When you reuse a Bitcoin address, it becomes easy to identify the participants in the transaction. Because the Bitcoin blockchain is public, it can be accessed by anyone interested in finding out the identity of a user. Below we will examine the primary ways that address reuse poses risks for your business.

Consumer Risk

There are already public databases and projects that help de-anonymize Bitcoin transactions and their participants. There is also speculation that this lack of privacy is incompatible with many modern consumer protection laws.

Consumers don’t want third parties having access to their purchase history. Many companies provide a single payment address or QR Code – they may not even realize they’re leaving their customers open to vulnerability.

Business Risk

While the discussion around address reuse often focuses on consumer risk, there are plenty of other risks associated with traditional Bitcoin wallets. Using a single address through a traditional wallet to accept payments allows individuals to link your business to your Bitcoin address. This will make your revenue and earnings publicly available to competitors and third-parties.

In addition, information about your suppliers and your customer base will also become vulnerable. If you want to stay away from the prying eyes of competitors, a payment gateway that helps avoid address reuse might be very helpful.

How to Avoid Address Reuse

If you want to provide a variety of transaction methods for your customers, there’s never been a better time to start accepting Bitcoin as currency.

The best practice for avoiding address reuse is to use a different address for every transaction. If you never use the same address, it’s impossible for analysts to track you or your customers’ transaction histories. This is the best way to shield your customers, suppliers, and payments from prying eyes.

But creating new wallets and addresses for every transaction can be impossible to do on your own. You need a service that can generate new addresses for every digital currencies transaction you process within your business.

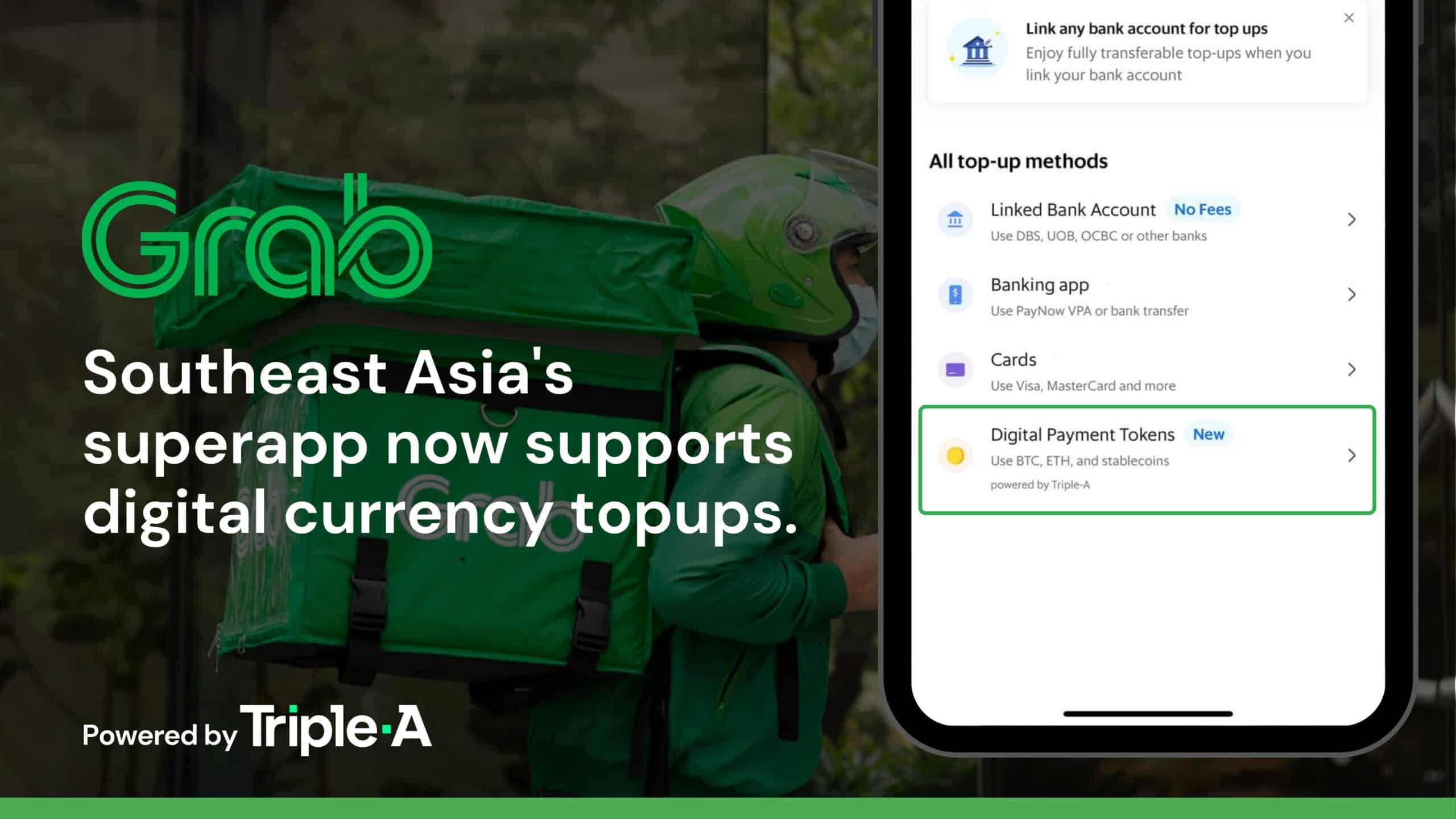

Triple-A service ensures the same Bitcoin address is never used twice – you won’t have to worry about any transaction-related privacy risks.