What is Ethereum?

With Ethereum’s upgrade to the London Hard Fork, let’s look into Ethereum, the second-biggest digital currency worldwide, based on its market value. There are two components to Ethereum, a blockchain platform with its own digital currency called Ether (ETH), and a programming language known as Solidity. Vitalik Buterin first proposed Ethereum in 2013; he was also one of the pioneers behind the Bitcoin blockchain to expand the technology to include more use cases beyond transactions.

How does Ethereum work?

Just like most digital currencies, Ethereum’s blockchain platform is a decentralized, distributed blockchain network where all transactions are verified and recorded. Everyone participating in the blockchain network will have access to an identical copy of this ledger, letting them see all past transactions. The mining of Ethereum happens on the network by solving complex mathematical problems and adding new blocks to the blockchain system. Miners are then rewarded with the Ethereum token.

Ethereum intends that the Internet was meant to be decentralized. With that, developers can build and publish smart contracts and distributed applications (dapps) with Ethereum’s technology, without running into the risks of downtime, fraud, or interference from others (Investopedia). Today’s applications are storing personal data on other people’s computers, in clouds, and servers owned by companies like Facebook, Google, or even Paypal. And this means we have less direct control over our data as the intermediary can step in and prevent us from any action. Therefore, Ethereum wants to change how these applications work, granting us more control over our personal data (Coindesk).

What can Ethereum be used for?

It is a popular investment option as it’s seen rapid gains in price, increasing by over 600% from one year ago. Just like Bitcoin, Ethereum owners use Ether digital currencies to purchase goods and services. Overstock, Gipsybee, G2A are businesses that accept Ether as payment.

Ethereum’s vision is to decentralize applications and services, from social media networks to complex financial agreements. One use case was Microsoft partnering with ConsenSys to offer Ethereum Blockchain as a service (EBaasS) on the Microsoft Azure cloud. The service is to provide Enterprise clients and developers with a single-click cloud-based blockchain developer environment (Microsoft).

What’re the differences between Ethereum and Bitcoin?

1. Primary Purpose

Both Bitcoin and Ethereum are popular virtual currencies and a store of value. The decentralized Ethereum network was intended as a platform to facilitate immutable, programmatic contracts and applications via its currency. Ethereum can also be used to process other types of financial transactions and store data for third-party applications. On the other hand, Bitcoin does not offer such functions.

2. Processing Speed

Ethereum processes transactions much faster than Bitcoin. New blocks are validated on the Bitcoin network once every 10 minutes, while new blocks are validated on the Ethereum network once every 12 seconds.

3. Token Limit

A limited amount (21 million coins) of Bitcoin tokens can be mined on its network, but there is no limit to the amount of Ether on the Ethereum network. From an investment perspective, Ethereum may not appreciate as much as Bitcoin.

What is Ethereum’s London Hard Fork upgrade all about?

The proposal named “London” is a permanent upgrade that aims to change the way transaction fees, or “gas fees,” are estimated on the Ethereum network.

Currently, users must go through blind bidding to have their Ether transaction picked up by a miner. This can be extremely costly and inefficient as people may be paying much higher “gas fees” to secure the transaction. With the upgrade, the blockchain will automatically determine the “gas fees” to eliminate sudden price hikes across the platform.

The London Hard Fork includes a fee reduction feature called EIP 1559. The fee cut already eliminated US$2 million worth of Ether in only a few hours since taking effect, according to the tracking website ultrasound.money. And that could push Ether’s price upward going forward. “1559 is definitely the most important part of London and it is proof that the Ethereum ecosystem is able to make significant changes,” said Vitalik (Bloomberg).

The London Hard Fork upgrade changes the fundamental structure of the blockchain from a PoW (Proof of Work) to PoS (Proof of Stake), which will eventually lead to lesser energy usage. This will significantly improve the sustainability and relevance of the Ethereum network in the future.

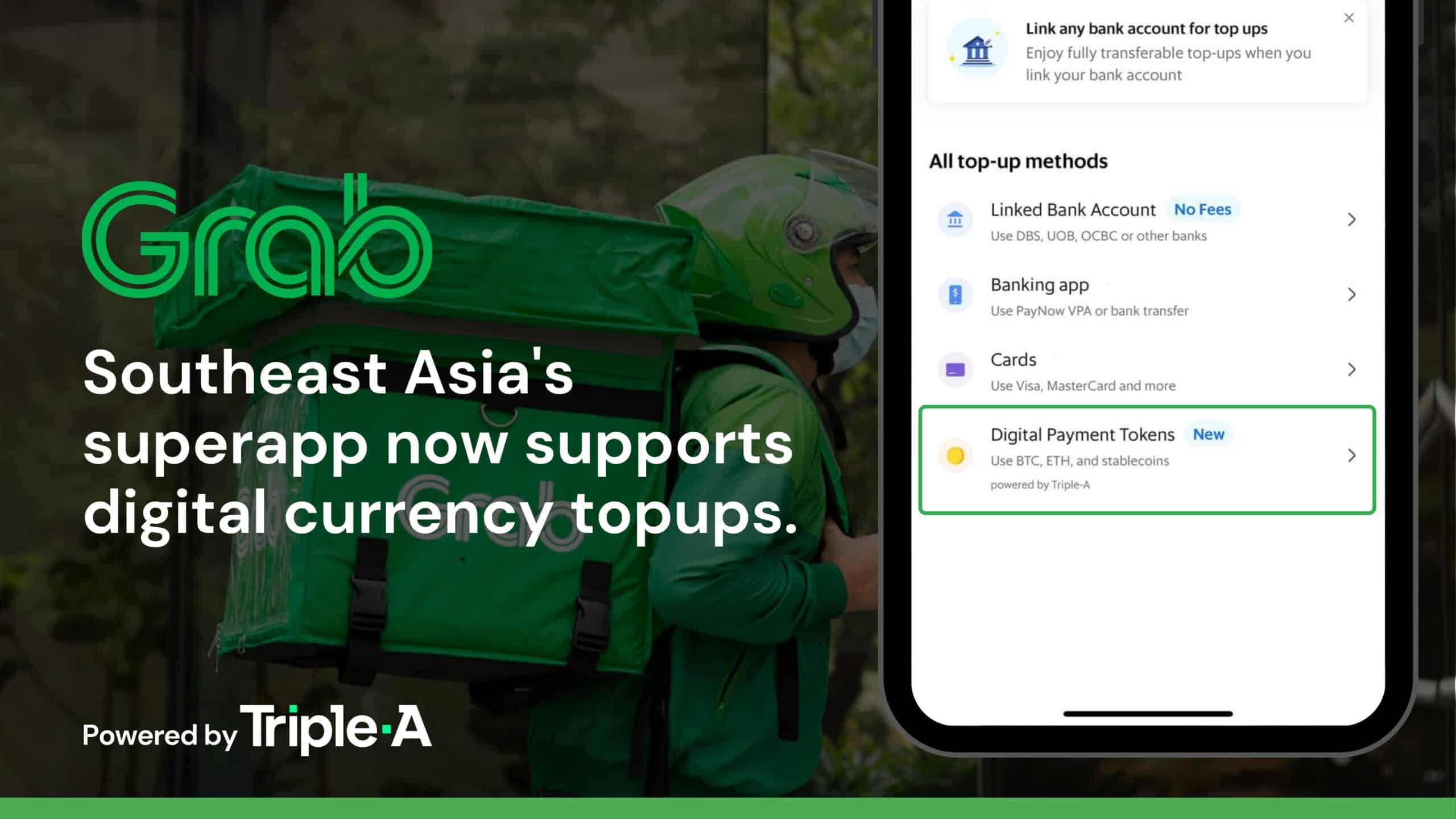

Accepting Ethereum as payments

Many businesses are already accepting Bitcoin and Ethereum as payments. As the price of Ethereum spiked after the launch of the London Hard Fork, we see rising interest of businesses wanting to accept Ethereum as payments. Here at Triple-A, we facilitate businesses to accept Ethereum with zero price volatility risk by converting them to local currencies in real time. Book an appointment with us now if you want to learn more about accepting Ethereum for your business.