In recent years, digital currency payments have emerged as a powerful tool for businesses to reach new customers, increase revenue, and streamline their operations. As of May 2024, 562 million people in the world own cryptocurrencies, and a growing number of people (and businesses) are turning to crypto as an easier, more practical, and safer way to transact.

Early adopters include businesses across a wide range of verticals, with many in the e-commerce, B2B, payroll, and PSP (payment service provider) sectors using crypto as a more efficient way to settle payments, including internationally. Other sectors, like hospitality and retail, have also started to accept crypto to meet demand for digital currency payments from a growing segment of their customers and clients.

Despite the advantages, for many businesses the core challenge of accepting crypto payments is that it is usually a complicated process, and cryptocurrency values can swing wildly from day to day. This makes holding, trading and converting cryptocurrencies an unattractive option. What most of those businesses aren’t aware of is that there is a much simpler approach.

In this guide, we break down how businesses can easily benefit from crypto payments without the risks of holding and trading in crypto. We also explore exactly how crypto payments work, the benefits of accepting digital currency payments, and the easiest and most secure approach for incorporating them into your business’s operations.

Whether you’re a new entrepreneur or an established business looking to expand your payment options and stay ahead of industry trends, this guide is your go-to resource for navigating the world of crypto payments effectively. Ready? Let’s dive right into it.

Demystifying Crypto Payments

Since the first usage of Bitcoin in 2009, crypto has taken the world by storm, transforming the way we think about money and transactions. Their decentralised nature, and emphasis on peer-to-peer payments, allow anyone to access, use and benefit from this novel financial system, making it easy to understand why crypto has become so popular.

In fact, when we surveyed over 7000 consumers to gauge their attitude towards crypto in 2023, we found that 65% of consumers said they’d like to be able to make payments in digital currencies. And 55% said they’d choose an online store that accepts crypto payments over one that doesn’t.

For businesses looking to boost their sales, attract new customers and stay ahead of the competition, the trend is clear. Accepting cryptocurrency payments offers a strong alternative avenue for business growth. But given the traditional volatility of crypto markets, many businesses have shied away from this opportunity, losing revenue and clients in the process.

Below, we outline a ‘hands-off’ approach businesses can leverage to incorporate this new payment method without being exposed to the complexities and volatility risks associated with cryptocurrencies.

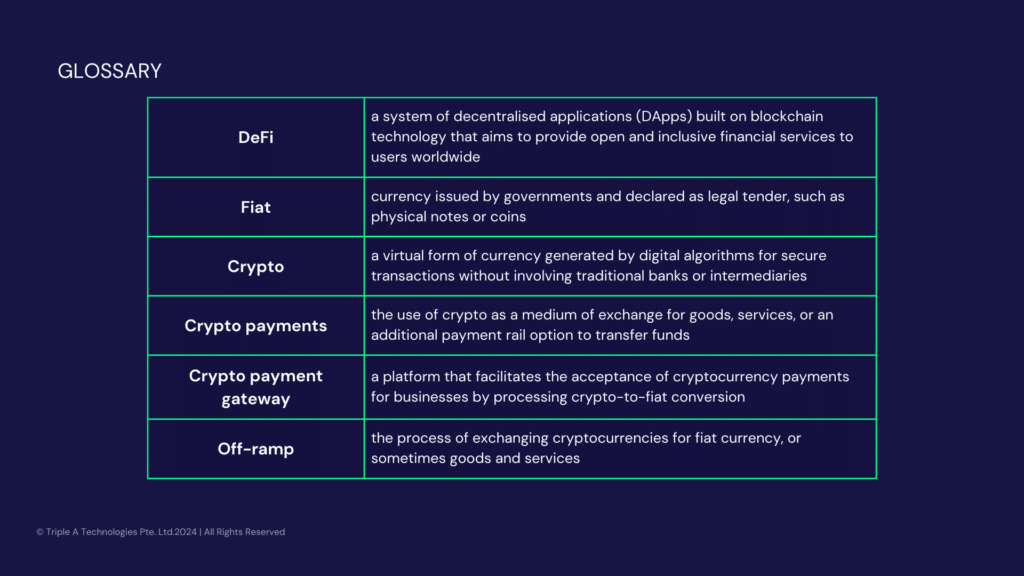

But before diving into the specifics, let’s have a look at some important terminology and concepts in the cryptocurrency space.

Making sense of crypto payments

Before outlining how your business can start accepting payments in crypto, it’s worth taking a moment to understand exactly how cryptocurrency payments work and why they are gaining traction in the payment landscape.

How do crypto payments work?

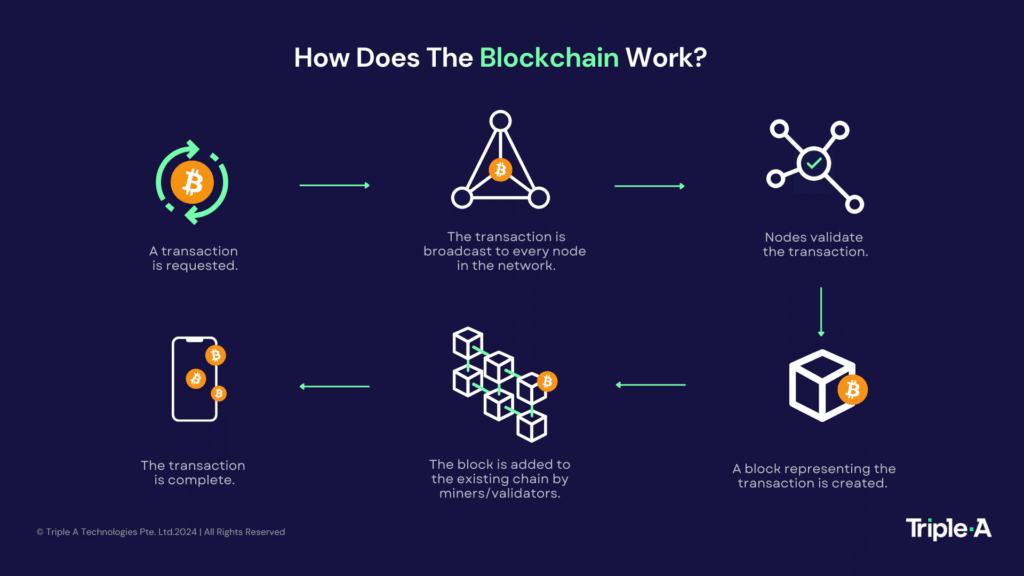

Crypto payments are processed using blockchain technology. The blockchain is a distributed ledger that records every transaction made between users (i.e. private individuals or businesses), in perpetuity.

It is operated by a network of “nodes” representing individual computers that maintain a copy of the entire blockchain and play a crucial role in validating transactions. This network means the blockchain is transparent and immutable. Once a transaction is completed, it cannot be cancelled or changed in any way.

Payments are typically made between cryptocurrency “wallets” owned by users and businesses.

Cryptocurrency transactions are final and cannot be reversed, eliminating the risk of chargeback fraud. In case of transaction disputes, the decision to grant a refund is under the merchant’s control.

Key Takeaways:

✅ Crypto payments use blockchain technology which cannot be cancelled or changed, providing transparency and security.

✅ Crypto payments offer merchants full control over refunds, preventing chargeback fraud.

What are the different types of cryptocurrency “wallets” available?

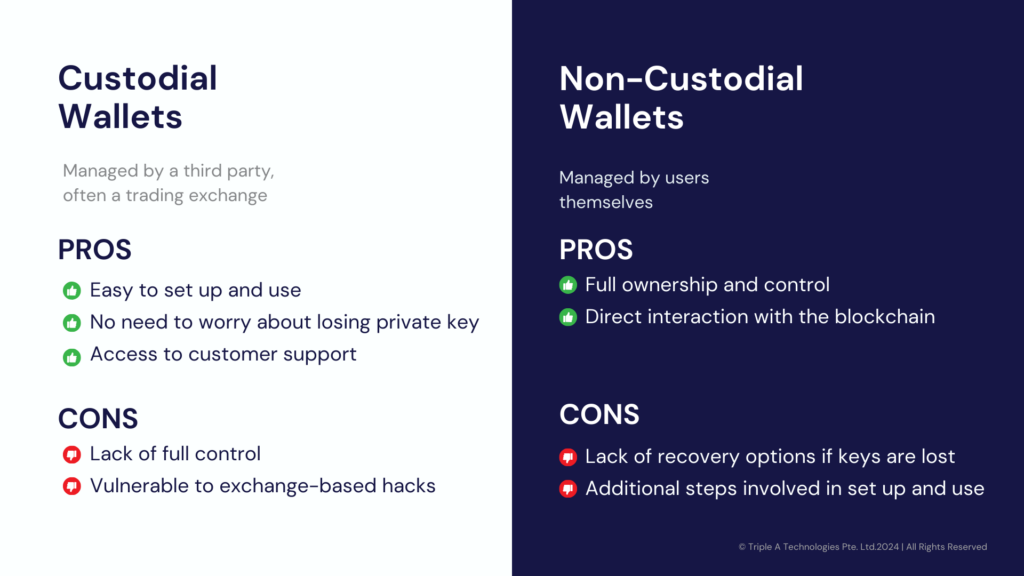

To make payments in crypto, users hold a crypto wallet that is a combination of a private key and public address. You can think of the public address as a bank account number, and the private key as a pin number which gives the user access to their cryptocurrency.

When it comes to choosing a wallet, the main ideas to consider are ease-of-use, security, and control. The table below outlines the two main types of crypto wallets (custodial and non-custodial), their advantages, and their drawbacks.

A Wallet-Agnostic Approach with Triple-A

In addition to the two wallet types, there are a wide range of services and apps that provide crypto wallets. This means your customers may be using non-custodial wallets like MetaMask and Ledger, or they may pay with their custodial wallets linked to centralised cryptocurrency exchanges such as Crypto.com and Binance.

No matter what type of wallet your customers use, Triple-A’s crypto payment solutions are fully compatible.

Being wallet-agnostic ensures your business can cater to a wide range of customers, maximising the benefits of crypto payments.

Key Takeaways:

✅ Triple-A’s solutions are compatible with all types of cryptocurrency wallets, including custodial and non-custodial wallets.

What are the different types of cryptocurrencies?

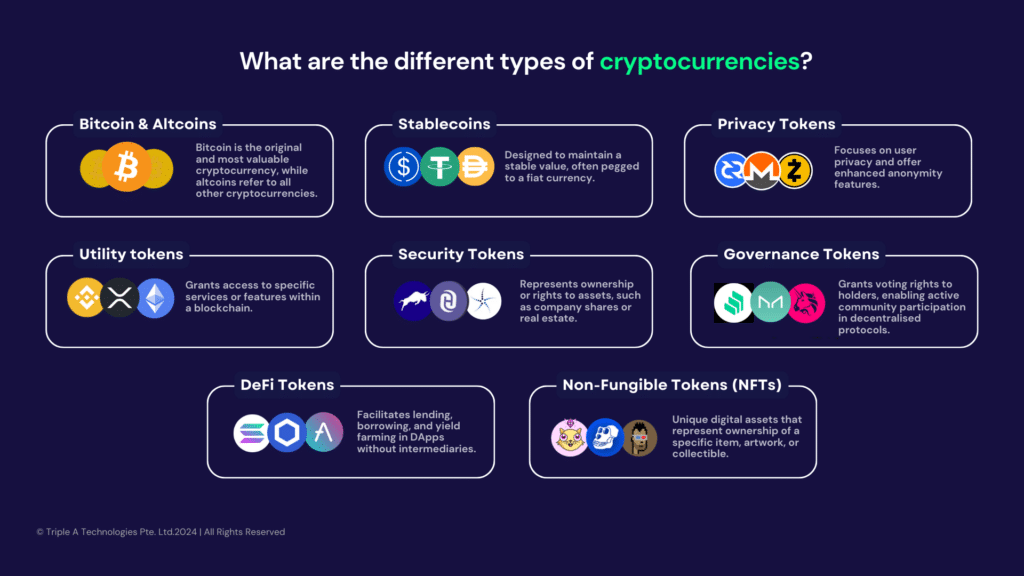

Cryptocurrencies can be categorised into different types based on their functions, features, and underlying technologies.

Note: The categories listed in the image above are not exhaustive, and instead serve to highlight the many distinct features of cryptocurrencies. As the blockchain space continually evolves, new hybrid tokens may emerge, blurring the lines between traditional classifications.

An additional concept worth mentioning is Central Bank Digital Currencies (CBDCs). CBDCs are digital currencies that aim to provide a digital representation of a country’s fiat currency. These currencies are issued by central banks, though at present their real-life rollout and adoption is still in very early stages.

In today’s market, the most preferred consumer cryptocurrencies are typically stablecoins like Tether (USDT) and USD Coin (USDC), or well-known tokens such as Bitcoin (BTC) and Ethereum (ETH). As of May 2024, Bitcoin (BTC) makes up 53% of the total crypto market cap, standing at a formidable $1.38 trillion. Meanwhile Ethereum’s (ETH) market cap sits at $449 billion while Tether (USDT) and USD Coin (USDC), two prominent stablecoins renowned for their price stability, have market caps of $111 billion and $33 billion, respectively.

These established cryptocurrencies offer stability, liquidity, and widespread adoption, making them suitable choices for businesses embracing crypto payments.

Key Takeaways:

✅ The cryptocurrencies most relevant to consumers and businesses are BTC, ETH, USDT & USDC, making up the bulk of crypto payments and driving massive daily transactional volumes.

What are the benefits of accepting crypto?

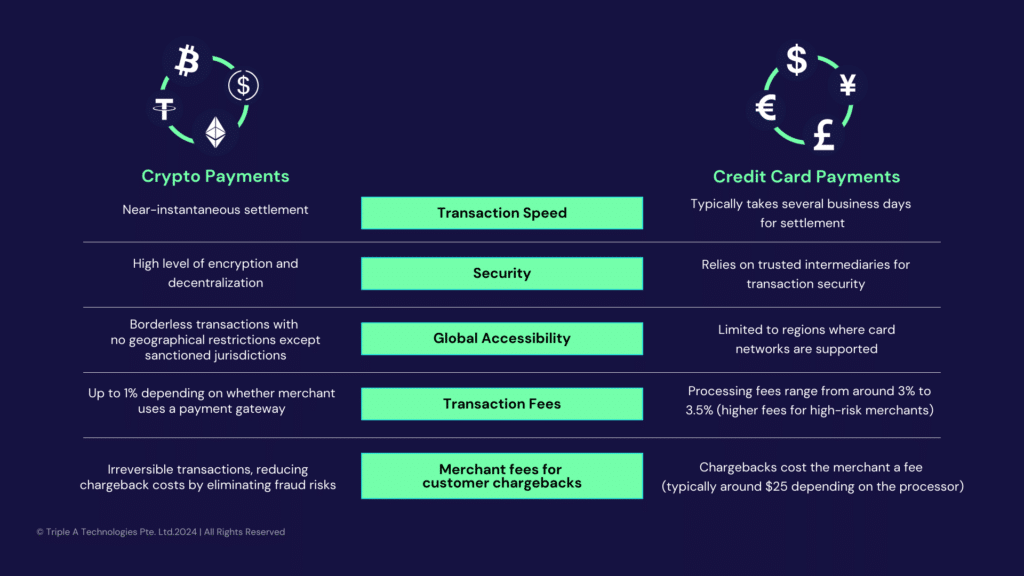

Crypto payments are fast, secure and cost-effective, and offer many additional benefits for both your business and your customers. The table below outlines the key differences between crypto payments and card payments, and shows how crypto payment methods often outperform their traditional counterparts.

Here at Triple-A, we see crypto payments as complementary to existing payment methods. Cryptocurrencies provide businesses access to different customer segments characterised by their unique preferences, such as valuing the security aspects provided by crypto or having greater confidence in decentralised payment systems. They also open up opportunities to increase customer spending, with 43% of consumers surveyed saying they’d spend more online if they could pay in crypto.

In addition to addressing the limitations of traditional payment methods, cryptocurrencies provide a distinct mode of payment preferred by specific customer segments.

Considering the benefits for merchants and consumers, it’s no surprise that crypto payments are growing in popularity. And in the coming years, that popularity will continue to grow, making crypto payment integration a “must-have” for many businesses.

Key Takeaways:

✅ Accepting crypto offers benefits like speed, security, cost-effectiveness, and access to an additional customer segment.

✅ Cryptocurrencies represent a distinct payment method that complements, rather than overlaps with traditional payment systems.

The benefits of accepting payments in crypto through a payment gateway

While cryptocurrency payments do offer distinct advantages when compared to traditional methods, there are also underlying concerns of relevance for businesses. These include:

- Security — Handling crypto assets requires robust security measures, including secure wallet management, protection against hacking attempts, and safeguarding private keys. Implementing these security best practices can be challenging and time-consuming for individual merchants or businesses.

- Compliance — Accepting crypto payments as a merchant involves navigating complex regulatory requirements and ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Failure to meet these compliance standards can result in legal consequences and reputational damage.

- Volatility — Cryptocurrencies are known for their price volatility. While stablecoins can help mitigate this issue, many merchants prefer to avoid the potential fluctuations in the value of cryptocurrencies like Bitcoin and Ethereum, as these can affect revenue and profitability. Therefore, it’s crucial to use a reliable crypto payment gateway that can instantly convert cryptocurrencies to fiat currency.

- Finance — Managing bookkeeping for crypto transactions can be complex, especially considering the need to track conversions, transaction fees, and tax implications along with other fiat transactions.

Streamlining the crypto payment process

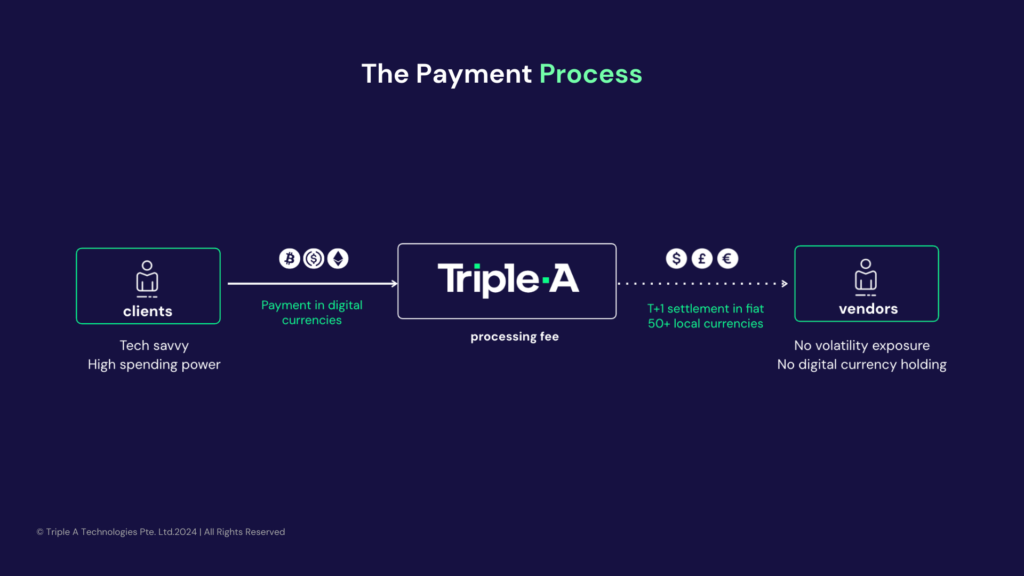

To overcome these challenges and streamline the acceptance of crypto payments, many businesses opt for payment gateway services. Using a payment gateway like Triple-A removes drawbacks like volatility and the security concerns of a cryptocurrency wallet while giving companies access to all the benefits of accepting crypto payments.

Payment gateways ensure that crypto payments are as low risk and secure for businesses as possible. This includes making digital currency payments refundable at the business or merchant’s discretion, as well as basing refunds on fiat value to avoid volatility.

Using Triple-A, businesses can easily allow their customers to pay with cryptocurrency. Those payments are then converted into fiat and transferred to the merchant’s bank account the next day, eliminating any risk associated with holding crypto.

Using crypto payment gateways allows businesses to enjoy the benefits of crypto payments without having to hold crypto on their balance sheets. This shields businesses from the complexities of handling crypto, enabling them to focus on what truly matters.

Key Takeaways:

✅ A licensed crypto payment gateway like Triple-A addresses security, compliance, and volatility concerns, allowing businesses to focus on growth and simplifying the payment process.

Integrating your crypto payment solution

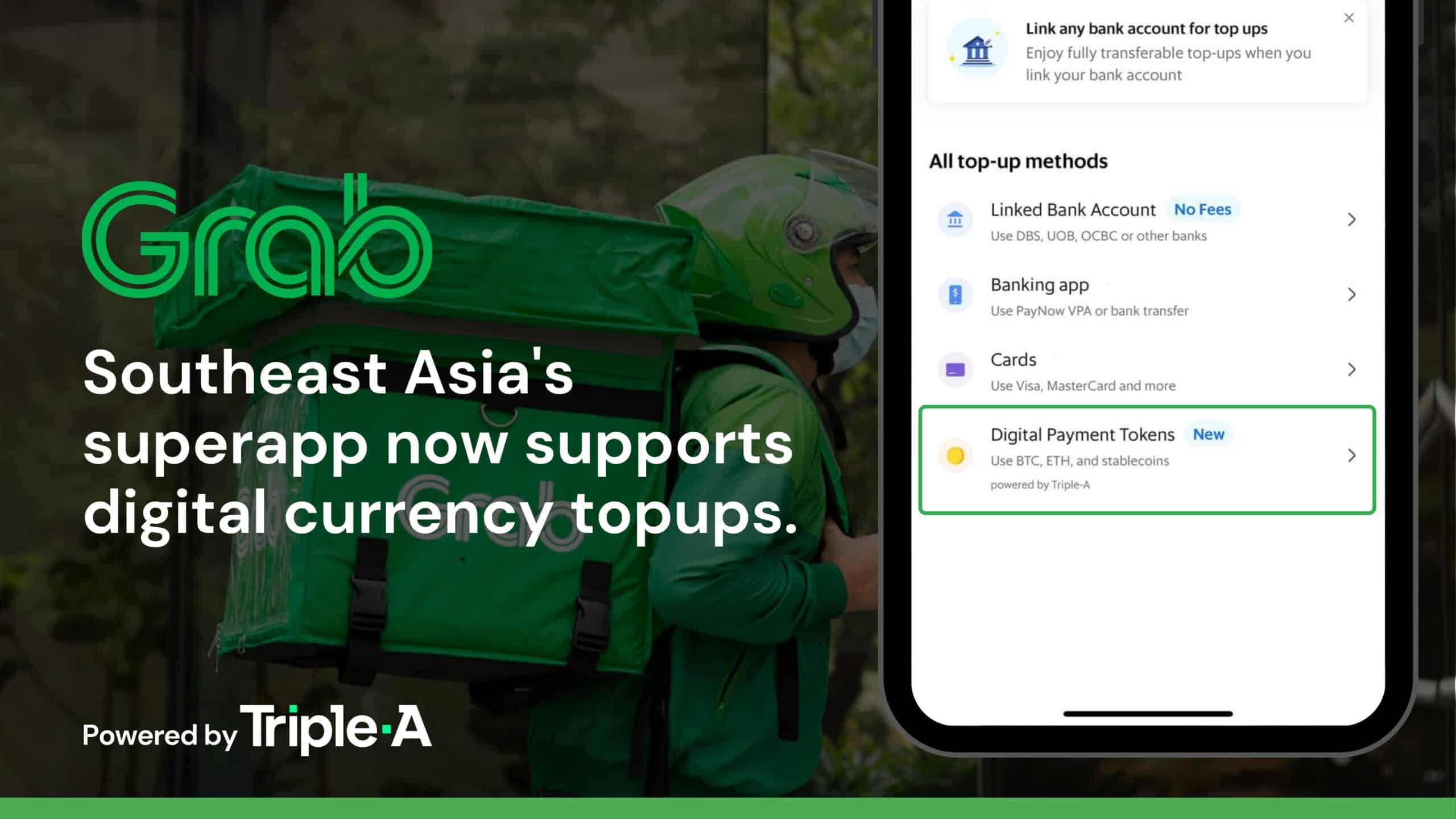

In 2024, outsourcing crypto payments has become mainstream. Payment gateways like Triple-A provide seamless integration solutions that make the process of accepting crypto easy and hassle-free for businesses.

Which integration option do I choose?

API (Application Programming Interface) Integration

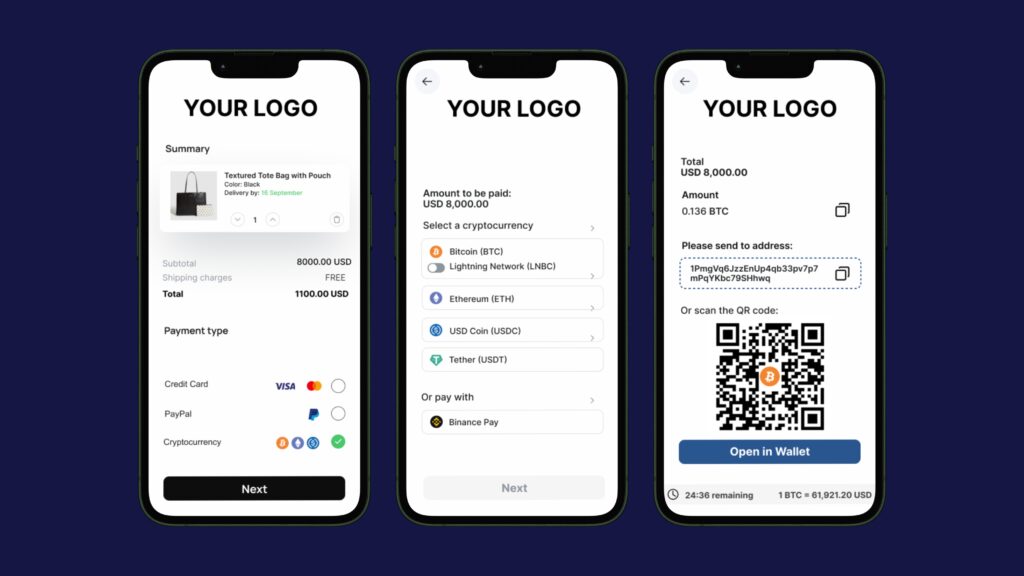

API integration allows businesses that are not built on an ecommerce platform to facilitate rapid, easy cryptocurrency payments. This option also gives your business more flexibility and control over the payment process, allowing you to customise it according to your brand. API integration options include an embedded URL payment form or an external URL payment form hosted by Triple-A.

The Triple-A payment form redirects users to an external URL to complete their payment, after which they are redirected back to your site. Meanwhile with the embedded URL payment form, customers can complete the entire payment journey without ever leaving your website.

Platform Plugin Integration

Businesses which are built on existing e-commerce platforms can use Triple-A’s direct plugin integrations. There are a selection of plugins available for popular e-commerce platforms like Opencart, WooCommerce, and Wix and these allow businesses to accept crypto payments on their website without any coding knowledge required.

No Integration

Businesses may also create payment requests via Triple-A’s invoicing tool and can facilitate crypto payouts without the need for integration. By simply setting up a Triple-A account and accessing the merchant dashboard, you can quickly leverage these features with the help of a user-friendly and no-code solution.

The merchant dashboard can also be used to manage crypto payments effectively, regardless of the integration option chosen. This allows businesses to easily match incoming payments to corresponding orders, ensuring a smooth, seamless payment process.

Key Takeaways:

✅ Triple-A’s integration options include customisable API integration, e-commerce platform plugins or integration-free payouts, for maximum business flexibility in accepting cryptocurrency payments.

Customising the payment experience

Using Triple-A’s white label API solutions, businesses also have the flexibility to customise payment form setup and can choose how the form will appear across all consumer-facing channels (e.g., websites, apps). This allows you to tailor the payment experience to match your brand, creating a lasting impression and contributing to a positive overall user experience.This includes adding business logos and personalised messages to the payment interface for a cohesive and engaging user experience.

Additionally, the back-end elements of the payment process can also be adjusted to ensure compatibility with existing systems and workflows, and to boost business utility. These elements include:

- Notifications

- Dashboards, and

- Reports

Key Takeaways:

✅ Triple-A’s white label payment solutions allow for a customisable payment experience, incorporating business branding and personalised elements.

Ensuring success with crypto payments

For businesses new to the crypto space, there are a few additional points to consider as you integrate cryptocurrency payments into your existing payment landscape.

Marketing crypto payments to customers

Though the number of businesses accepting crypto payments is growing, this is still a distinguishing feature worth marketing to your customer base. Many businesses add their use of crypto payments to marketing collateral, in addition to promoting it through their websites and social media touchpoints.

Providing how-to guides, FAQs, and support channels adds further value in addressing questions your customers may have. This also encourages your customer base to embrace the simplicity and convenience of using crypto payments with confidence.

Additional options include incentives such as loyalty points, discounts, or exclusive deals to customers who choose to pay with cryptocurrencies. These marketing initiatives not only attract new customers but also encourage larger basket sizes among existing customers who are more likely to spend with crypto.

Key Takeaways:

✅ Promoting crypto payments with marketing and incentives attracts new customers and increases sales.

Reaping the benefits of crypto safely and responsibly

As the regulatory landscape surrounding cryptocurrencies is constantly evolving, it’s crucial to ensure a secure experience for both your customers and your business. Working with a licensed crypto payment gateway, like Triple-A, simplifies this process, reducing the need to navigate legal complexities.

Triple-A is a Payment Institution licensed by the central banks of Singapore (Monetary Authority of Singapore ) and France (ACPR, AMF). We are also registered as a Money Service Business (MSB) with FinCen, the Financial Crimes Enforcement Network, a bureau of the United States Department of the Treasury.

In addition, Triple-A conforms to the following regulatory practices:

- FATF Travel Rule – AML/CFT compliance — to ensure compliance with its AML / CFT (anti-money laundering and combating the financing of terrorism) obligations Triple-A monitors transactions occurring on the blockchain to detect any potential risks or illicit activities with the help of advanced blockchain analysis tools, such as Elliptic and Chainalysis.

- Sanction List Screening – Triple-A conducts checks against databases such as the Office of Foreign Assets Control (OFAC), Politically Exposed Persons (PEP), and other relevant regulatory lists. This helps businesses and business owners to prevent engagement with individuals or entities involved in illicit activities.

- Know Your Customer (KYC) — Triple-A follows a robust KYC process, verifying the identities of merchants and ensuring compliance with anti-money laundering (AML) regulations. This helps mitigate the risk of fraudulent activities and maintains a trustworthy ecosystem.

Our payment solutions have strong compliance processes in place, allowing businesses to operate in a fully regulated environment. This ensures peace of mind as businesses embrace digital currency payments.

Key Takeaways:

✅ Partnering with a licensed digital currency payment institution like Triple-A, which employs advanced blockchain analysis tools and robust KYC processes, enhances business safety and regulatory compliance.

Final thoughts

In the current competitive landscape, businesses must use all tools at their disposal to set themselves apart from the competition and drive engagement with their products and brands.

By accepting crypto payments, many businesses globally are already attracting new customers, giving their existing customers new options, and tapping into the often higher purchasing power of cryptocurrency users. Underlying this adoption is the convenience and ease of accepting digital currency payments using a licensed crypto payment gateway, like Triple-A.

By letting Triple-A handle all of the conversion and transfer processes, businesses enjoy:

- Zero risk of volatility

- Instant confirmation of all cryptocurrency transactions

- Next day settlement of crypto payments with funds paid into business accounts in fiat currency

- Compatibility with all cryptocurrency wallets, for ease and flexibility in accepting payment

- No chargeback costs and low transaction fees

For tens of thousands of businesses around the world, that means enjoying the benefits of accepting cryptocurrencies as a form of payment without any of the hassle of managing crypto. Shouldn’t yours be one of them?