Cryptocurrency Ownership Data

Learn about Cryptocurrency Adoption across the globe: Trends, Insights and Statistics

Global cryptocurrency adoption

Cryptocurrency adoption is growing around the world. As a leading cryptocurrency payments company, we strive to offer key statistics to help businesses better understand the cryptocurrency market—how you can reach untapped markets and grow your business. As of 2024, we estimated global cryptocurrency ownership rates at an average of 6.8%, with over 560 million cryptocurrencies users worldwide.

Leading Countries by Crypto Ownership Percentage

UAE

25.3%

Singapore

24.4%

Türkiye

19.3%

Argentina

18.9%

Owners Demographics

61%

Male

39%

Female

US$25,000

is the annual income of the average cryptocurrencies owner

71%

have a Bachelor’s degree or higher

72%

are aged under 34

Cryptocurrency ownership data

| Country | Data Year | Population | Ownership | Ownership Percentage | Report |

|---|---|---|---|---|---|

| India | 2023 | 1,428,627,663 | 93,537,015 | 1,428,627,663 | View Report |

| China | 2023 | 1,425,671,352 | 59,134,683 | 1,425,671,352 | View Report |

| United States | 2023 | 339,996,563 | 52,888,108 | 339,996,563 | View Report |

| Vietnam | 2023 | 98,858,950 | 20,945,706 | 98,858,950 | View Report |

| Pakistan | 2023 | 240,485,658 | 15,879,216 | 240,485,658 | View Report |

| Philippines | 2023 | 117,337,368 | 15,761,549 | 117,337,368 | View Report |

| Brazil | 2023 | 216,422,446 | 25,955,176 | 216,422,446 | View Report |

| Nigeria | 2023 | 223,804,632 | 13,261,259 | 223,804,632 | View Report |

| Iran | 2023 | 89,172,767 | 12,000,000 | 89,172,767 | |

| Indonesia | 2023 | 277,534,122 | 12,205,132 | 277,534,122 | View Report |

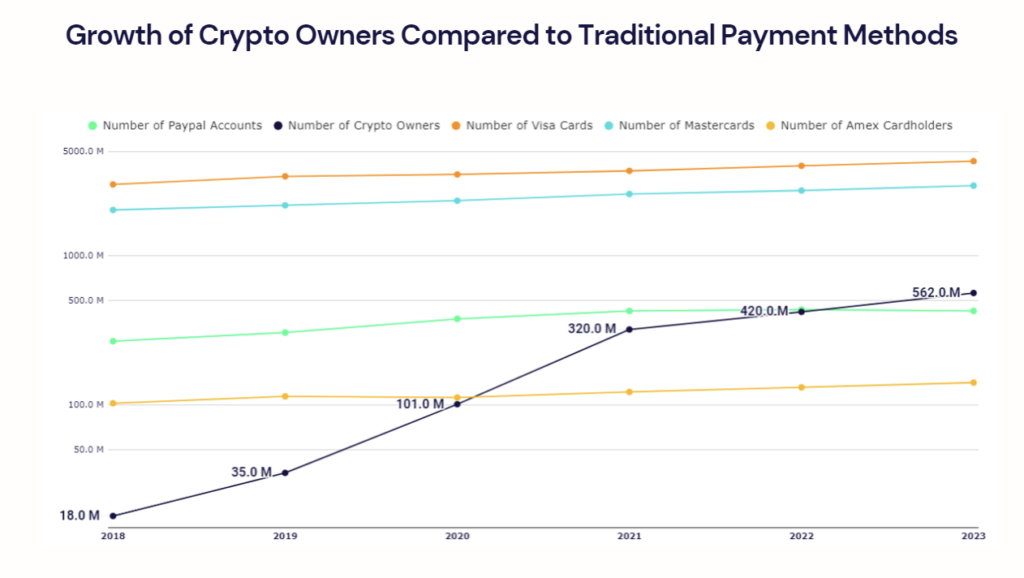

Cryptocurrency’s Rapid Growth: A Five-Year Surge

With a compound annual growth rate (CAGR) of 99%, the growth in ownership of cryptocurrencies far exceeds the growth rates of traditional payment methods, which average at 8% from 2018 to 2023. In fact, within the same period, the growth rate for cryptocurrency ownership surpasses that of several payment giants such as American Express.

Source: Paypal, Visa, Mastercard, Amrerican Express

Cryptocurrency across industries

E-Commerce

Luxury

Remittance

Gaming

85%

More than 85% of US merchants view enabling cryptocurrencies payments as a high priority

327%

Merchants who accepted cryptocurrencies payments saw an average ROI of 327% and an increase of up to 40% of new customers

$250

Customers who use cryptocurrency spend about $250 more per transaction on average than what the average customer spends

Download Our Report: The State of Global Cryptocurrency Ownership in 2024

Get the latest insights on digital currency ownership in our full report and discover the strategies driving success in this exciting new market!

About the Methodology

For the latest TripleA Global Cryptocurrencies Ownership data, TripleA utilized the

following metrics: (i) Country Weighted Scoring, (ii) Global Weighted Scoring, (iii)

Outlier Research and (iv) Primary Data Collection to obtain the most encompassing and

accurate set of statistics in conjunction with the various data sources that we evaluate.

i. Country Weighted Scoring

Our ownership data is derived based on the report “The Chainalysis 2022 Geography of

Cryptocurrency Report” in which each country is given a score based on 3 factors:

(1) the country on-chain cryptocurrency value received, (2) the country on-chain retail

value received, and (3) the Peer-to-Peer exchange trade volume

Our number of users per country estimations are based on Canada’s score and a recent

Central Bank of Canada report, which estimates that 5% of the Canadian population own

cryptocurrencies. In order to estimated for all the countries, we calculated the

correlation between the Chainalysis score (=0.196) and the Central Bank ownership = 5% and

then applied the same rationale to other countries’ scores.

ii. Global Weighted Scoring For reports with findings on global cryptocurrency ownership,

our number of users per country estimations are then based on the global data findings

from the report. For example, in a recent University of Cambridge report which estimates

that 1.83% of the worldwide population own cryptocurrencies, we applied the data across

all countries to obtain the cryptocurrency ownership findings.

iii. Outlier Research For the specified countries: (a) China, and (b) India, in-depth

research and data sampling was conducted due to the inherent nature (i.e large population

size) of these countries that resulted in less accurate findings based on the above 2

approaches. Data collected from third-party providers and local TripleA data is then

evaluated to obtain a more precise figure for the specified countries.

iv. Primary Data Collection TripleA has recently embarked on market research projects for

select countries and we will be gradually expanding the scope of countries. Ownership

results from the market research are representative of the national population of each

country and are used in the evaluation and benchmarking along with the other methodologies

utilizing secondary data sources.

The dataset from TripleA was supplemented with additional research and web scraping using

commonly applied methodologies. Furthermore, publicly available data from a variety of

sources was used to complement survey data. Utilizing data that are crunched with numerous

criterias, various databases and significantly different factors, the processed data and

findings are then weighed and analysed against each other based on the following

benchmarks (i) Time of Publishing (ii) Scope and Scale of Survey (iii) Internet

Penetration Rate for selected big, developing countries (iv) to obtain a finalised

ownership number specific to each country. Hence, TripleA believes that our benchmarking

study accurately captures the global economic activity in the cryptocurrencies asset

industry.

A total of 16 reports and surveys were included and weighted to derive at our final

numbers. These sources include:

- FCA UK

- PYMNTS

- PSYMA

- Finder

- Finder Cryptocurrencies Report

- RBK Russia

- Gallup

- University of Cambridge

- Cryptocurrencies.com

- Bank of America

- Gemini

- NORC

- IFOP

- Statista

- Willy Woo

The data contained or reflected herein are proprietary of Triple-A.

Sign up to the Triple-A Newsletter

Stay tuned about our services, industry news & the most up-to-data data on digital currency ownership and trends worldwide.