May 14, 2021 | 5 min read

Serving more than 100 customers from 36 countries, Scorechain helps different types of businesses in their digital currencies compliance journey, from digital currency companies to financial institutions with digital currencies trading, custody branch, digital assets customers onboarding, to audit and law firms.

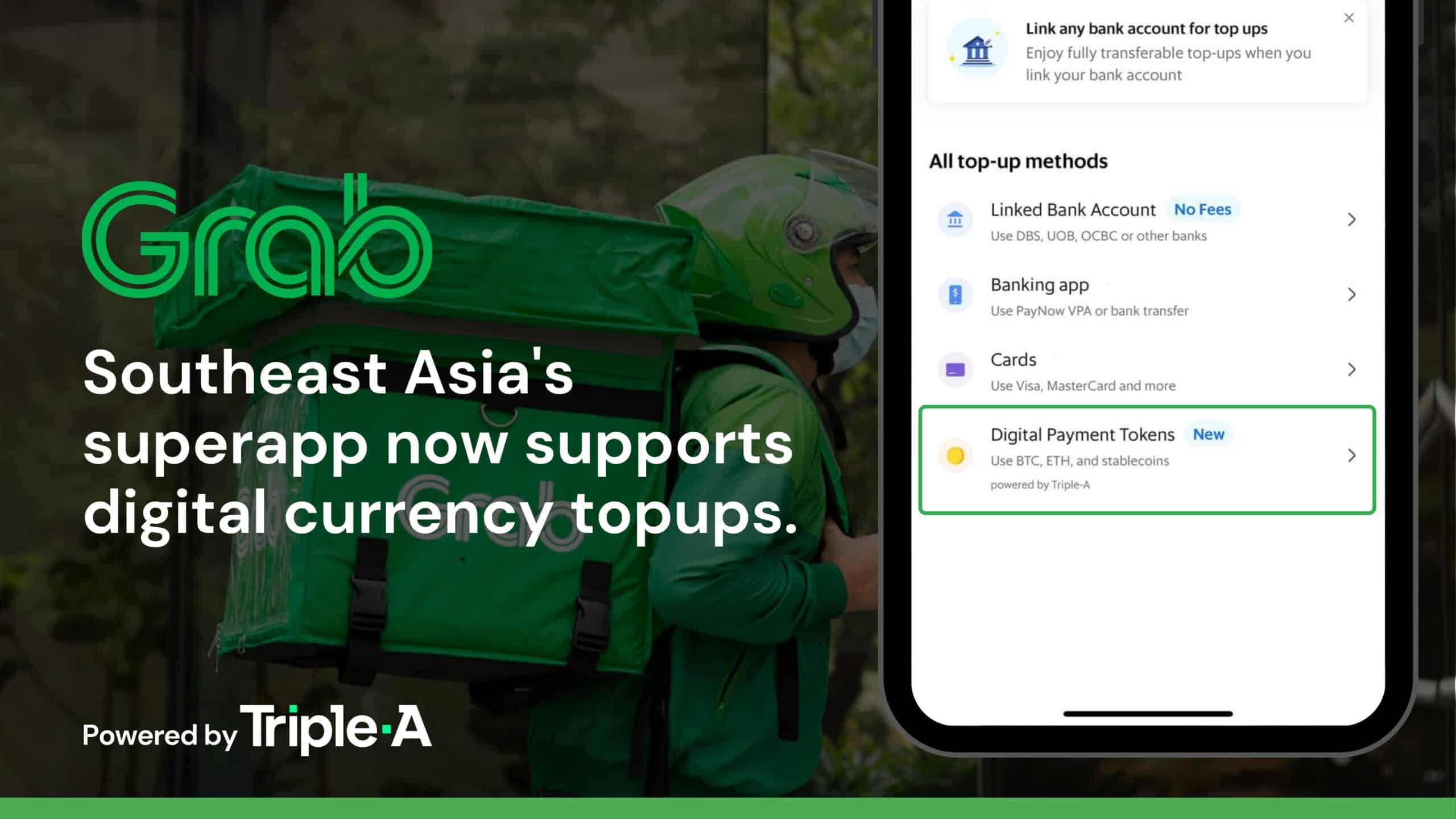

We are pleased recently to interview one of our loyal customers: Triple-A, a digital currencies payment gateway that empowers online and offline businesses to accept digital currency payments. Founded in 2017 in Singapore by Eric Barbier, Triple-A is compliant with the Monetary Authority of Singapore (MAS), Singapore’s Central Bank under the Payment Services Act for Merchant Acquisition service and Digital Payment Token service, and complies with the highest international security standards.

Grace Lok, Business Controller at Triple-A, shared with us their experience with Scorechain in regard to digital currencies compliance, digital currencies AML standards and digital currency payment.

Scorechain: To what extent is it important for Triple-A to implement a risk-based approach to digital currencies transaction monitoring? What processes are you following to implement such an approach?

Grace Lok: At Triple-A, we prioritize our clients’ best interests and ensure the source of digital currency received are legal; hence, we perform a risk assessment on each and every of our merchants to keep their transactions safe and secure.

Scorechain: What are the criteria when you choose your digital currencies AML & Compliance software provider?

Grace Lok: The accuracy and reliability are of utmost importance as they play a big part in ensuring safe and secure transactions, and at the same time, for us to comply with MAS regulatory standards.

Scorechain: Could you mention 3 main reasons why you corporate with Scorechain?

Grace Lok: Having worked with Scorechain for near 2 years, we value the in-depth investigation trail, broad coverage of databases, and the support provided by Scorechain.

Scorechain: Which features are the most useful for your daily compliance work? Could you explain with some examples?

Grace Lok: I find the detection of bad transactions from illegal sources most beneficial as Scorechain can flag out the transactions from illegal sources almost instantaneously. It has also helped to reject the bad transactions and help us stay compliant with our regulators.

Scorechain: What do you think about the future of digital currency payment?

Grace Lok: Bitcoin commercial payments exceeded US$5 billion in 2020. And it’s clear that digital currency has become mainstream. However, as digital currency gains popularity, there’s a possibility that illegitimate usage from digital currenciess such as dark web, mixer, and hackers will increase. Therefore, we must continue to strengthen our compliance process to build trust and credibility with our clients.

Many thanks to Triple-A and Grace Lok for their time dedicated to our interview and especially for their trust to Scorechain all the time.

Testimonial from Scorechain for Triple-A:

Scorechain is glad to count Triple-A as one of its proud customers and to help them in their digital currencies compliance journey.

Today, digital currencies are more and more popular; the digital currency usage for illegal activities grows with their popularity though. With Scorechain digital currencies compliance software, Triple-A can adopt a risk-based approach to digital currencies transaction monitoring to stay compliant with their regulators and prioritize their client’s best interests by ensuring the source of digital currency received is legal.

Like Triple-A, worldwide digital currencies-related businesses are using Scorechain solution to identify illegal digital currencies funds to mitigate the ML/TF risks. Doing so is vital for securing digital currencies markets and sustaining the development of digital currency payments and broader digital currency adoption.

Original source: https://blog.scorechain.com/experience-sharing-from-scorechain-customer-triplea/

About Scorechain

Scorechain is a Risk-AML software provider for digital currencies and digital assets. As a leader in digital currencies compliance since 2015, the Luxembourgish company serves worldwide customers in 36 different countries with more than 150 licenses established, ranging from digital currency businesses to financial institutions with digital currencies trading, custody branch, digital assets customers onboarding, audit and law firms and some LEAs.

Scorechain solution supports Bitcoin analytics with Lightning Network, Ethereum analytics with all ERC20 tokens and stablecoins, Litecoin, Bitcoin Cash, Dash, XRP Ledger and Tezos. The software can de-anonymize the Blockchain data and connect with sanction lists to provide a risk scoring on digital assets transactions, addresses and entities. The risk assessment methodology applied by Scorechain has been verified and can be fully customizable to fit all jurisdictions. 300+ risk-AML scenarios are provided to its customers with a wide range of risk indicators so businesses under the scope of the digital currencies regulation can report suspicious activity to authorities with enhanced due diligence.

www.scorechain.com

contact@scorechain.com

About Triple-A

Triple-A aims to revolutionize how businesses and customers are connected through blockchain technology and digital currency solutions. With its easy setup, its highly competitive exchange rate, and its no-chargebacks payment system, Triple-A helps businesses to increase their revenue by accessing the growing digital currency users (200m+) community from all over the world.

Founded in 2017 in Singapore, Triple-A is compliant with MAS (Singapore Central Bank) and complies with the highest international standards for AML and KYC. The company currently operates in Singapore with a presence in Hong Kong and Europe and is quickly expanding worldwide.