Cryptocurrency adoption in South Africa in 2022

of South Africans own cryptocurrency

It is estimated that over 5.8 million people, 9.44% of South Africa’s total population, currently own cryptocurrency.

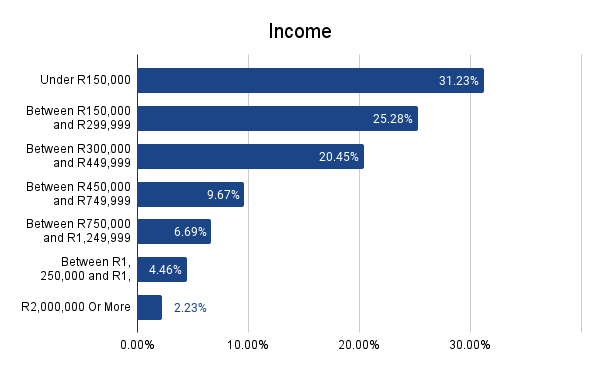

Breaking down cryptocurrency ownership by income, 77% of South African cryptocurrency owners have an annual income of R450,000 and less. This suggests that cryptocurrencies are largely owned by low to middle income South Africans.

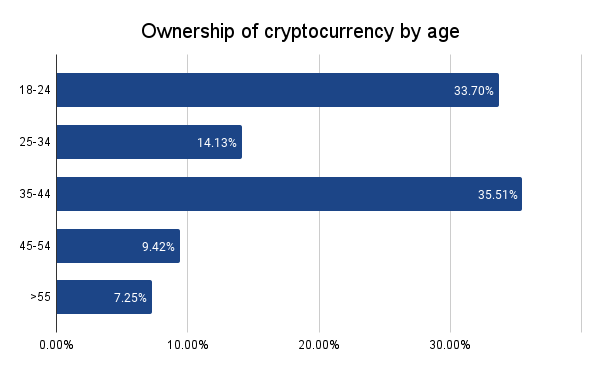

A large majority of South African cryptocurrency owners are in the 18-44 age group (83%). Only 7% of them are 55 and above. This suggests that cryptocurrencies are largely owned by South African millennials.

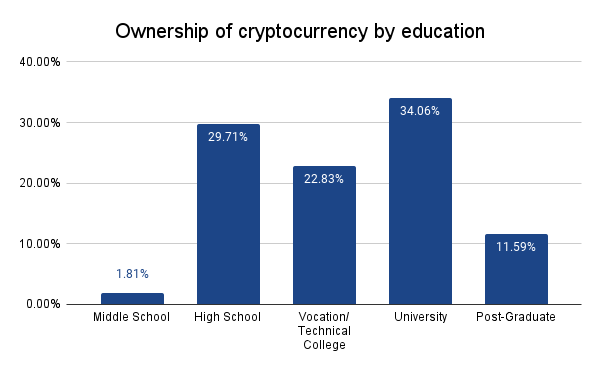

South African cryptocurrency owners are likely to be highly educated, 46% of them hold a bachelor’s degree or higher.

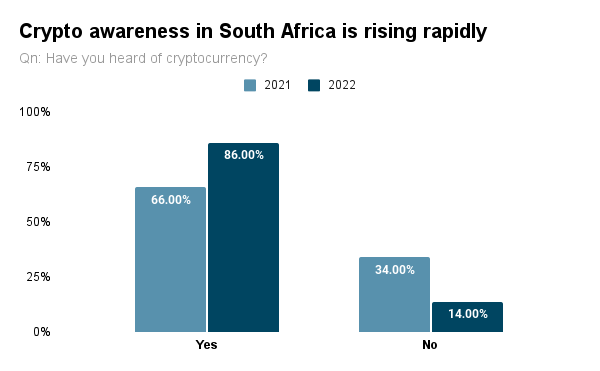

From our survey conducted, we see a staggering 86% of South African adults have heard of cryptocurrencies. This has risen across our data findings by a significant 20 percentage points in 2022 – from 66% in 2021.

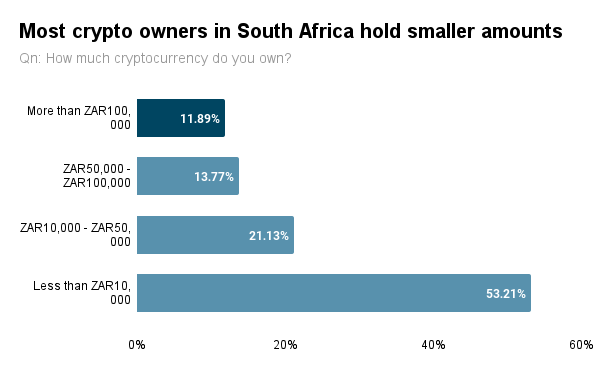

People are increasingly seeing cryptocurrency as a safe asset and alternative to national currencies, with more than 46% of cryptocurrencies owners having more than ZAR10,000 in cryptocurrencies assets. A significant number of cryptocurrencies owners (12%) also have more than ZAR100,000 in cryptocurrency.

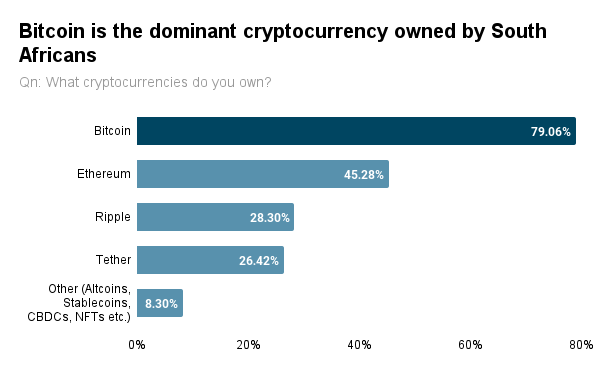

Bitcoin remains the popular choice for cryptocurrencies owners in South Africa, with more than 79% of cryptocurrencies owner respondents possessing Bitcoin. Ethereum follows closely in second place with the cryptocurrency’s wide application cases, followed by Tether (USDT), Ripple (XRP) and other Altcoins.

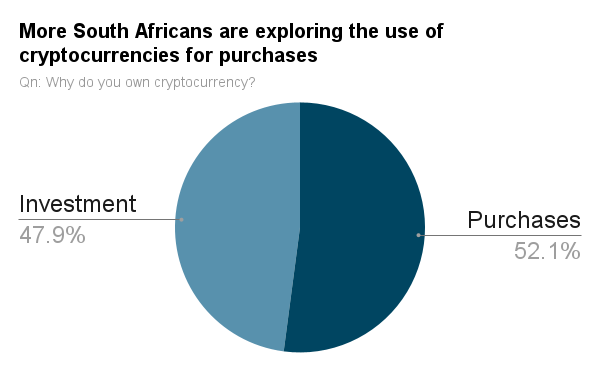

Majority of South African cryptocurrency owners (52%) are already using cryptocurrency for purchases, suggesting that cryptocurrency is increasingly becoming a mainstream form of payment.

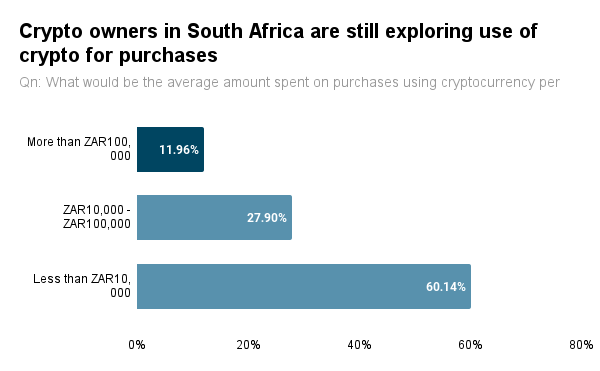

Around 40% of cryptocurrencies spenders are spending more than ZAR10,000 of cryptocurrency for purchases monthly, with a significant amount (12%) being large spenders of more than ZAR100,000 monthly.

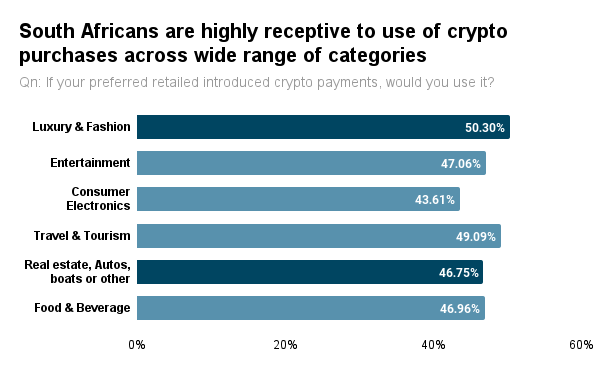

Survey results show that cryptocurrency payment services are eagerly anticipated across the retail industry. South African respondents showed interest in all the major categories ranging from Entertainment, E-commerce and Luxury Retail, etc.

Cryptocurrency is gaining the attention it deserves. 2021 was the year that cryptocurrency was in the spotlight as major institutions, celebrities and public figures all jumped on the cryptocurrencies bandwagon. Bitcoin and other cryptocurrencies also broke through all-time highs.

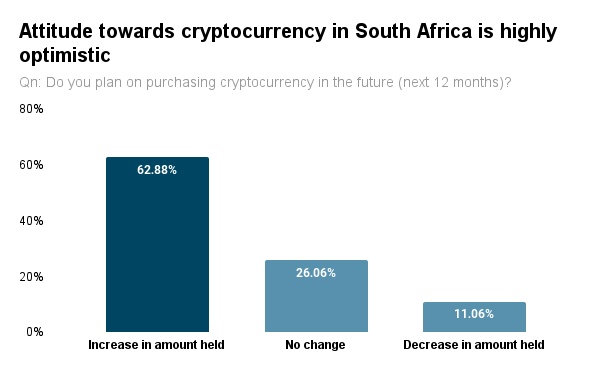

Majority of South African survey respondents (63%) are seeking to increase their holdings of cryptocurrency over the next year.

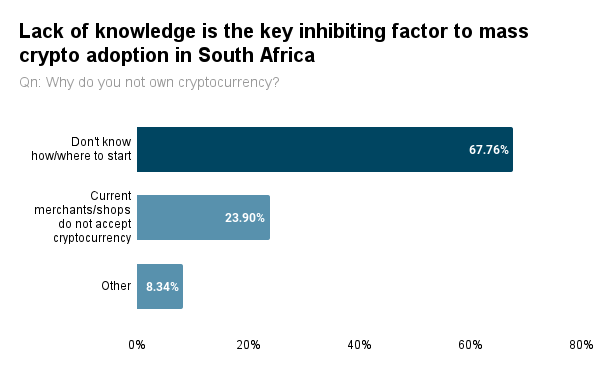

Majority of non-digital-currencies respondents (68%) cited a lack of knowledge, presenting strong potential for increasing cryptocurrency adoption with proper channelized education and awareness.

Additionally, greater adoption of cryptocurrency payment options across merchants can also have a network effect on more rapid adoption of cryptocurrency in the populace, given that 23.9% of respondents cited not owning cryptocurrency as their current merchants do not accept it.

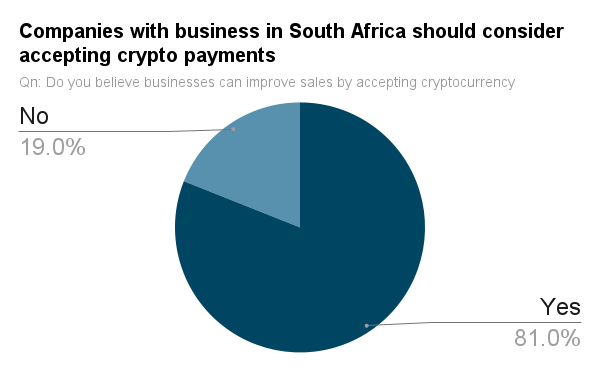

Given increasing cryptocurrency adoption in today’s world, businesses would benefit by integrating cryptocurrency payment into their payment ecosystem. In fact, 81% of South African cryptocurrencies respondents agree that businesses would stand to benefit from adopting cryptocurrency payments.

Licensed as a Major Payment Institution (MPI) by MAS, the Monetary Authority of Singapore. License number PS20200525. FinCen Registration number 31000227954985.

Licensed as a Payment Institution by the ACPR and registered as a Digital Asset Service Provider by the AMF under the aegis of Banque de France. Payment institution LEI: 969500VA4A8CRCS2N988

DASP No. E2023-079

Triple A Technologies Inc. is registered with the US Financial Crimes Enforcement Network (FinCEN) as a Money Service Business (MSB), number 31000261257720. Money Transmitter License Application (NMLS ID: 2514255)