Freelancing is not just a way to make money online, it’s a lifestyle choice that offers many benefits and opportunities. Freelancers are independent workers who offer their skills and services to clients on a project-by-project basis.

As more and more businesses turn to these freelancers as a flexible and cost-effective solution for their operational needs, the freelance market has made its mark on the global economy.

The global freelance industry is experiencing significant growth from its 2022 valuation of USD 4.4 billion, with the freelance platforms market projected to surge at an impressive CAGR of 16.5% from 2023 to 2030.

The impact of the freelance industry on a nation’s economy cannot be overstated. According to a recent report by Upwork, the world’s largest freelancing platform, there are over 60 million freelancers in the United States (39% of the U.S. workforce) alone, contributing $1.2 trillion to the economy in 2022.

This demonstrates the crucial role freelancers play in driving economic growth and innovation, not only across the U.S. but also on a global scale.

61% of freelancers own digital currency, and 56% of them are paid in digital currency

As freelancers navigate the ever-evolving landscape of the gig economy, a new phenomenon is capturing their attention and transforming the way they receive payments: digital currencies.

Digital currencies are digital currencies that are decentralised, secure and transparent.

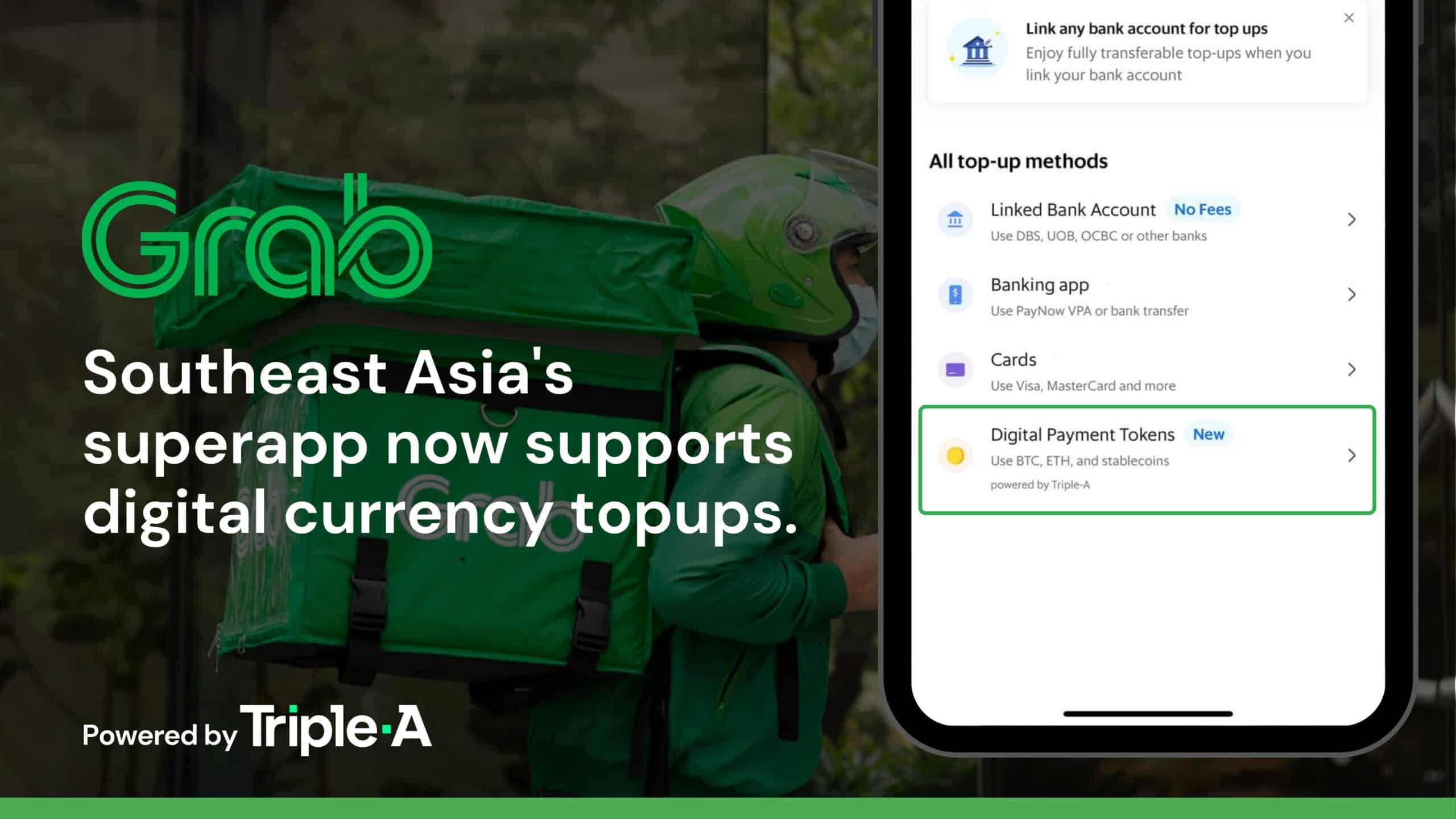

In recent years, there has been a significant surge in the adoption of digital currencies within the freelance industry. A study conducted by Triple-A among 11 major freelance markets revealed that 61% of freelancers currently own digital currency, and 56% of them have embraced digital currency payments for their services.

Moving past the big picture, let’s now have a look at the trends of digital currency ownership and payment adoption in the following markets:

When it comes to digital currency ownership, a significant percentage of freelancers in these countries have embraced digital currencies. Vietnam leads the pack with an impressive 85% of freelancers owning digital currencies, followed by Romania with 74% and Nigeria with 72%.

These markets demonstrate a higher level of ownership and acceptance, indicating a more established digital currencies culture within their freelance communities.

In terms of accepting digital currencies payments for their services, freelancers in Argentina emerge as the frontrunners, with a remarkable 84% of them open to receiving digital currencies. Colombia and Pakistan follow closely behind, with adoption rates of 64% and 63% respectively.

These markets showcase a strong acceptance of digital currencies payments, highlighting the preference of freelancers to embrace these digital assets as a form of compensation.

Digital currencies’s dominance in the gig economy

The statistics pinpoint a clear shift in the mindset of freelancers, as they recognise the advantages that digital currencies bring to their professional lives.

Streamlining payments across the fragmented freelance landscape

Freelancers hail from countries all over the world, each operating with its own currency and payment systems. This segmentation creates complexities when it comes to reconciling payments and conducting transactions.

Take the example of a freelance writer from the Philippines collaborating with a web development agency based in Australia. Before the writer gets paid via traditional wire transfer, he has to first cross the hurdles of currency conversions, exchange rate fluctuations, and complex banking procedures.

Digital currencies on the other hand offer a common global currency, enabling freelancers to streamline their financial operations and focus on what truly matters to them – nurturing their professional relationship with clients worldwide.

Digital currencies-native freelancers on the rise

As the freelance industry continues to evolve, a new generation of freelancers has emerged – the digital currencies-natives.

These individuals have been quick to develop their expertise in the dynamic ecosystem of decentralised finance, blockchain technologies, and emerging Web3 platforms.

One of the main reasons why digital currencies-native freelancers are early adopters of digital currencies is because they have a competitive edge over other freelancers in their field.

These forward-looking freelancers are not just using digital currencies as a virtual currency, but as a way to leverage the long term opportunities and innovations that the ecosystem offers.

Weathering economic uncertainty with digital currencies

Learning more about some of the countries’ economic circumstances can help to explain why freelancers in these markets are switching to digital currencies.

For instance, the annual inflation rate for the Argentine peso went from 10.46% in 2010 to a staggering 114% in 2023. Freelancers in Argentina have thus found solace in digital currencies as a means to preserve the value of their earnings amidst economic instability.

Governmental regulations on fiat currency trading and bank accounts during the economic crisis have made digital currencies an effective use case for many of these workers.

Similarly, in countries with limited access to traditional financial services and infrastructure, such as Nigeria and Kenya, freelancers face obstacles in receiving payments from international clients. While recent developments in alternative banking services in these countries have helped to boost financial inclusion, they still fall short in the case of currency devaluation during economic instability.

With digital currencies, however, borders become blurred and freelancers’ earnings are preserved, helping them to tap into global markets with ease.

As you can see, digital currencies adoption among freelancers is a complex and dynamic phenomenon that depends on various factors.

It is not a one-size-fits-all solution, but rather a flexible and adaptable tool that can serve different purposes for different people.

More companies are attracting global talent in the digital currencies-powered gig economy

As the freelance market continues to expand and evolve, understanding the benefits of digital currencies will become increasingly crucial for freelancers’ clients and platforms alike.

Businesses seeking to attract global talent among the remote workforce cannot afford to overlook the digital currencies-native freelancers who can navigate the evolving landscape of the digital economy.

For instance, Multiplier is a leading global employment platform that has partnered with Triple-A to offer payroll and freelancer payments in digital currencies. By leveraging Triple-A’s secure and efficient digital currencies payment gateway, Multiplier enables businesses to tap into a pool of talented individuals from around the globe.

This partnership not only streamlines payment processes but also positions companies as progressive employers embracing the future of work.

What’s next for freelance platforms and the creator economy?

As all parties become familiar with digital currencies, we can expect to see continued growth in the use of these digital currencies in the freelance economy. Hence, freelance platforms have the opportunity to facilitate these transactions and stand to benefit from them as well.

If you want to know more about how digital currencies payments are reshaping the freelance market, download our May 2023 report below. It highlights the growing acceptance of digital currency payments among freelancers worldwide due to the advantages it offers over traditional payment methods. This guide also provides a comprehensive overview of:

- Latest trends in digital currencies payments

- Insights into freelancers’ attitudes towards digital currencies

- Platforms that have supported digital currencies payments

- Benefits & Challenges of supporting digital currencies payments

- Freelancers’ future outlook on digital currencies

Download Our Report: Empowering Freelancers – The Rise of Digital currency Payments in the Gig Economy

___________________________________________________________________________________________

Start paying freelancers in digital currency

with Triple-A, a licensed digital currencies gateway.

Integrating a new payment method into your existing infrastructure has never been easier. With a licensed digital currencies payment gateway, the process is seamless and requires minimal effort on your part.

By entrusting Triple-A to handle all the conversion and transfer processes, you will:

- Avoid volatility risk

- Enjoy instant confirmation on all digital currency transactions

- Get settled in your bank account, in your local fiat currency, the next day

- Cater to all digital currencies wallet users. Our solution is compatible with all digital wallets.

This means that you can enjoy the perks of accepting digital currencies as a form of payment without the trouble of managing digital currencies.